Forecasts reveal the energy bill price cap is set to rise yet again in April when Ofgem makes the next price cap announcement on 25th February.

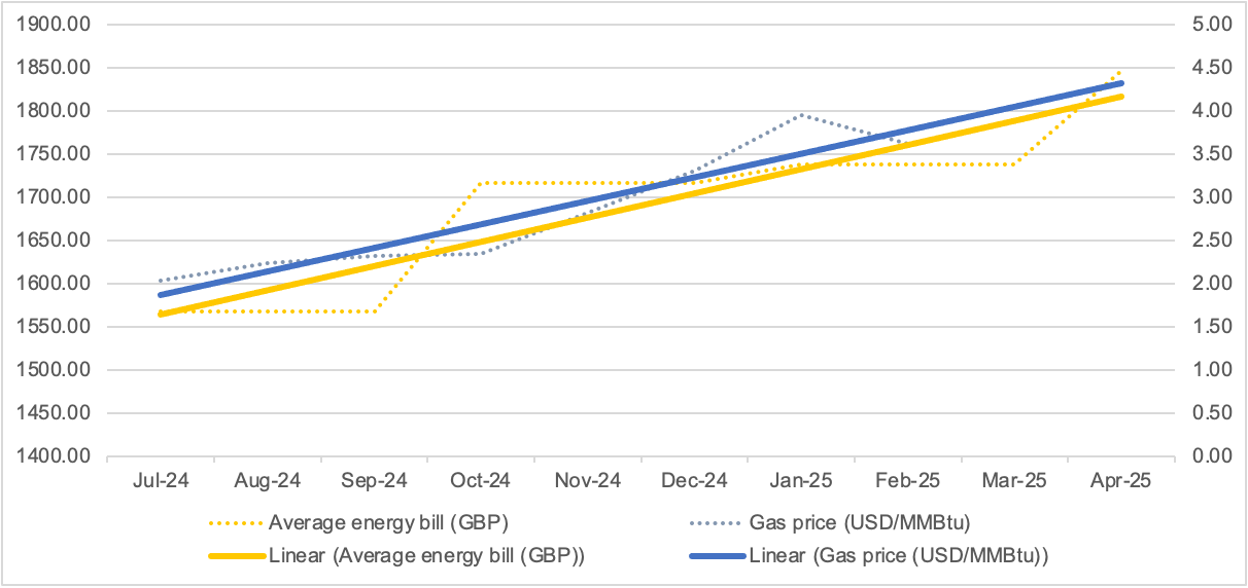

Meanwhile analysis of the energy market prices show that the increasing average household cost of energy directly mirrors a trend-line of gas prices since July 2024. [1]

At the heart of the challenge is the system that sees electricity prices being set by the cost of gas up to 40% of the time under the marginal pricing rules.

With the cost of gas rising to a two year high in recent weeks, the over reliance on fossil fuels in the country’s energy system is continuing to cause distress in households.

A spokesperson for the End Fuel Poverty Coalition, said:

“As volatile energy bills continue to be set by our reliance on global wholesale markets and driven by the cost of gas, it is even more vital that we see moves toward sustainable, cheaper, renewable energy.

“This of course needs to be combined with support for vulnerable households with their energy bills and investment in helping people make their homes more energy efficient – especially those living in low quality private rented homes.

“But until homes can be upgraded, consumers need to navigate a confusing array of energy tariffs. When comparing tariffs, customers must use their own energy usage and must not rely on industry averages as this may hide the true cost a household will pay.

“Customers also need to look out for exit fees which may trap you into uncompetitive tariffs in the future. And, if a household is interested in moving to a ‘tracker’ style tariff, it is even more important to make sure you look at your own usage, the unit costs and the standing charges and check that they will offer you real value for money.”

The current gas price surge is driven by the conflict in Ukraine, a colder than expected European winter and volatile wholesale markets operated by city market traders.

Campaigners have claimed that the latest energy price forecasts show customers are being gaslighted by an industry that has made £483 billion in profits since 2020.

Warm This Winter spokesperson Caroline Simpson said:

“It’s soul destroying that there will be another price cap rise. What billpayers don’t know is that even their electricity bills are chained to gas prices. This over reliance on gas – both for our heating and in setting the electricity price – is why we saw huge hikes in bills four years ago and now we are seeing prices set to rise again.

“Instead, the public are being told by some politicians that net zero and green policies are to blame which couldn’t be further from the truth and we need to stop gaslighting people.

“Our bills are high and the ones who benefit are greedy gas and oil companies who are making billions. That is why we desperately need to develop our own renewable energy sources as the only way to achieve lower prices and energy security for good.”

ENDS

[1] Raw data for chart as below.

| Date | Gas price (USD/MMBtu) | Average annual energy bill (GBP) |

| Jul-24 | 2.04 | 1568.00 |

| Aug-24 | 2.24 | 1568.00 |

| Sep-24 | 2.32 | 1568.00 |

| Oct-24 | 2.35 | 1717.00 |

| Nov-24 | 2.82 | 1717.00 |

| Dec-24 | 3.31 | 1717.00 |

| Jan-25 | 3.95 | 1738.00 |

| Feb-25 | 3.62 | 1738.00 |

| Mar-25 | Trend line | 1738.00 |

| Apr-25 | Trend line | 1846.00* or 1823.00** |

Source for Natural Gas Prices: Bloomberg taken on closest working day to 17th of each month. Source for Energy Bill prices: Ofgem / *Guardian 18/2/25 **BBC 18/2/25